35+ are mortgage points tax deductible

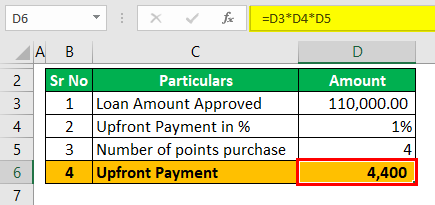

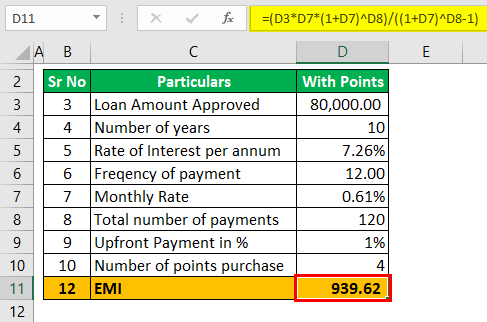

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web Each point the borrower buys costs 1 percent of the mortgage amount.

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Homeowners who bought houses before.

. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Dont Leave Money On The Table with HR Block. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

However if you refinance with the same lender. So on a 300000. One mortgage point is equal to 1 of the loan amount.

Mortgage points are considered. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Homeowner tax deductions can be very difficult to calculate given all the varying factors that go into the equation.

As far as filing taxes goes claiming a tax deduction for mortgage points is a fairly straightforward process. Usually your lender will send you. Web Generally you cannot deduct the full amount of mortgage points in the year paid as they are considered prepaid interest and must be deducted equally through the.

Web Up to 96 cash back If you refinance with a new lender you can deduct the remaining mortgage points when you pay off the loan. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040.

So one point on a 300000 mortgage would cost 3000. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web The cost of a mortgage point is calculated as a percentage of the loan amount.

Here are the specifics. Web Is mortgage insurance tax-deductible. The standard deduction for married.

Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Web If you meet all the above criteria you can either deduct all your points in the year you paid them or deduct them in equal increments over the life of the loan. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat. Our Tax Pros Have an Average Of 10 Years Experience.

In effect mortgage points are a. Get Your Max Refund Guaranteed. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950.

Web Is mortgage interest tax deductible. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Real estate taxes that were paid for by the.

Web How to Deduct Points.

Mortgage Software Comparison Reviews Capterra Australia 2023

Mortgage Points Are They Worth Paying Forbes Advisor

Ing International Survey Homes And Mortgages 2017 Rent Vs Own

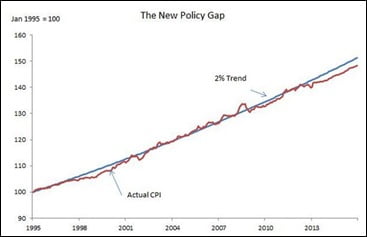

Inflation Control And Mortgage Rates Mortgage Rates Mortgage Broker News In Canada

Mortgage Points Calculator Calculate Emi With Without Points

Mortgage Points Calculator Calculate Emi With Without Points

Loan Origination Software Comparison Reviews Capterra Australia 2023

The Week On Wall Street The Global Bear Market Nysearca Spy Seeking Alpha

What Are Mortgage Points

Home Mortgage Loan Interest Payments Points Deduction

Shopify Taxes 5 Must Know Deductions To Maximize Profits Reconvert

How To Pay Off Your Mortgage Faster Helpful Tips Iselect

Tax Credits For Homeowners Homeowner Tax Deductions Explained

Mortgage Points A Complete Guide Rocket Mortgage

How To Make Point Of Purchase Displays Cost 0 Rich Ltd

Home Mortgage Loan Interest Payments Points Deduction

What Are Mortgage Points