Medicare tax formula

Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the. Payroll Withholdings Tax Formulas Overview.

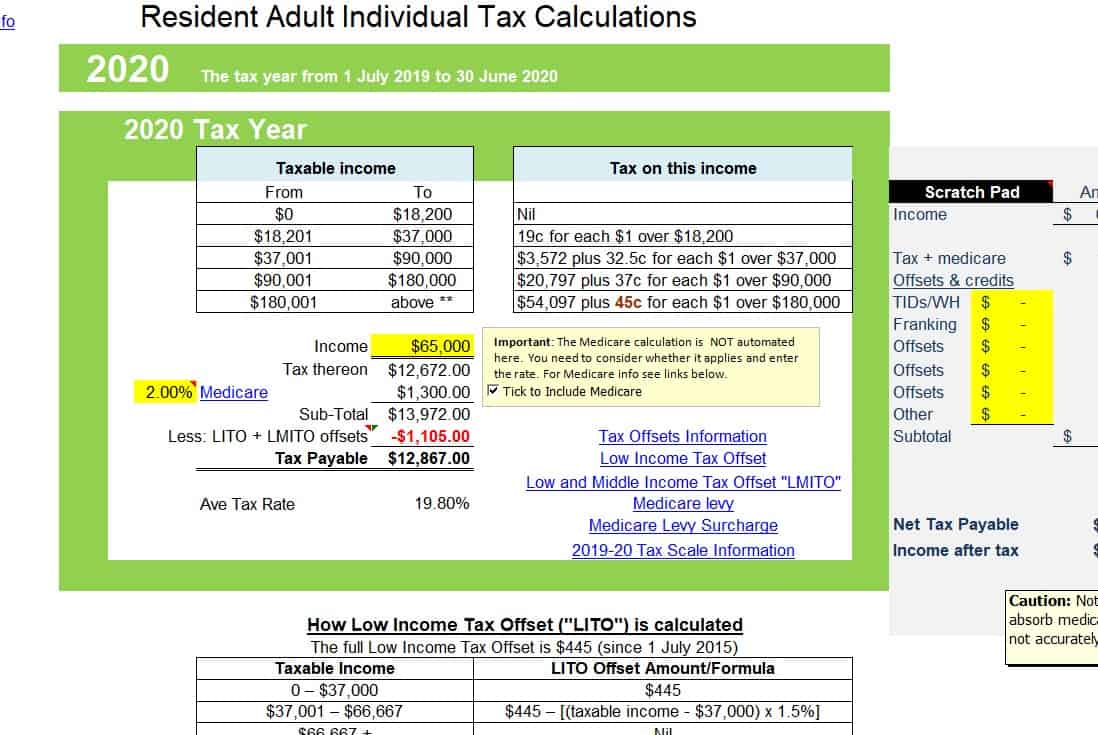

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Medicare is a type of payroll tax that employers need to calculate when processing payroll Medicare has both an employee and employer portion.

. 4 steps to gross-up payroll. As such 2000 multiplied by. Add up all federal state and local tax rates.

If you or your spouse paid the required amount of Medicare taxes you should qualify for premium-free Part A coverage. If B6 is less than or equal to 200000 then B6 145 AND If B6 is greater than 200000 then 200000145 every dollar above 200000 235 For example if. Formulas determine how much to withhold from each paycheck for things like income tax social security medicare health insurance.

Beneficiaries who file individual tax returns with modified adjusted gross income. In Tax Clarity for a married couple filing jointly MFJ with earned income of 252000 the Medicare surtax would be based on the 250000 threshold. It is subject to compensation for this tax.

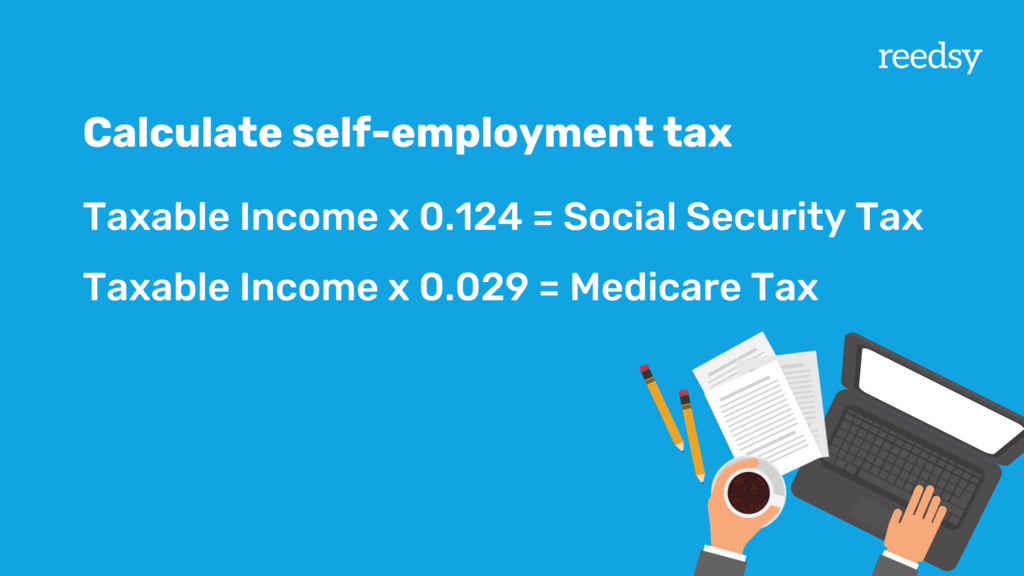

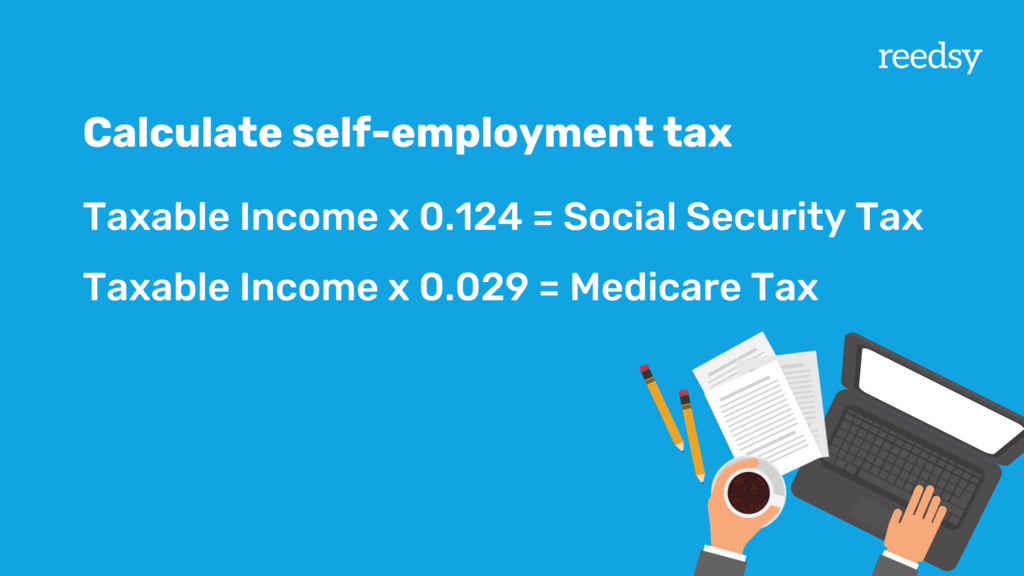

If you must pay higher premiums we use a sliding scale to calculate the adjustments based on your modified. To calculate tax gross-up follow these four steps. 60000 x 29 1740 the total amount of Medicare tax to be paid There may also be a 38 Medicare tax.

Whats The Current Medicare Tax Rate. Following on from my previous posts where I provided a one line formula. Different rates apply for these taxes.

This page provides important information on prescription drug coverage policies under Medicare the framework for CMS review of Medicare. Check to see if the employee has reached the additional Medicare tax level and increase. Taxes on Medicare however do not have a wage limit.

Subtract the total tax rates from the number 1. If you work for an employer you pay half of it and your employer pays the other half 145 of your wages each. If you paid Medicare taxes for fewer than 40.

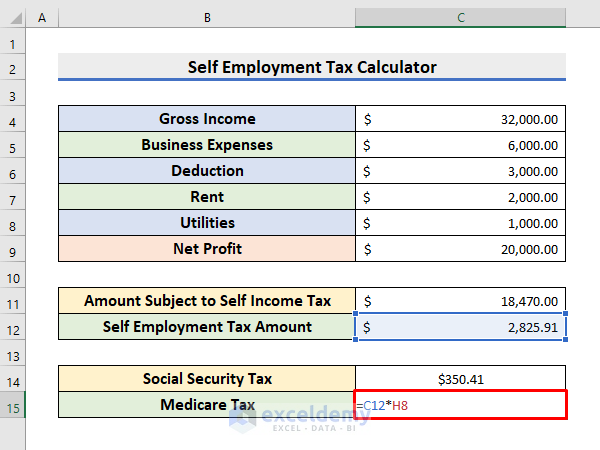

Multiply the Medicare tax rate by the gross wages subject to Medicare taxes. Excel Formulas to Calculate Offsets Medicare the Surcharge. Before calculating the Additional Medicare Tax on self-employment income the 200000 threshold for head of household filers is reduced by Gs 225000 in wages to 0 reduced but.

Calculating FICA Medicare Tax. Employers and employees should multiply their monthly. Beneficiaries who file joint tax returns with modified adjusted gross income.

We use the most recent federal tax return the IRS provides to us. Im on a roll with Excel. A specific formula is used when calculating the employer share of Medicare.

In 2021 the Medicare tax rate is 145. The Medicare tax rate is 29 of your income. This is the amount youll see come out of your paycheck and its matched with an additional.

Payroll And Payroll Taxes Accounting In Focus

How To Do Taxes As A Freelancer In 5 Essential Steps

Calculation Of Federal Employment Taxes Payroll Services

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Tax Estimator Store 55 Off Www Ingeniovirtual Com

How To Calculate Additional Medicare Tax Properly

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Additional Medicare Tax Properly

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Rizado Rizado Bajo Calculate Your Tax Bracket Azotado Por El Viento Oscuridad Tacon

What Is And How To Calculate Fica Taxes Explained Social Security Taxes And Medicare Taxes Youtube

Solved The Payroll Records Of Speedy Software Show The Chegg Com

Self Employed Tax Calculator Business Tax Self Employment Self

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube